In which sub-account and on which side of balance of payments account will foreign investments in India be recorded? Give reasons.

Foreign investments in India will be recorded in the capital account of the BOP account because these give rise to foreign exchange liabilities. Foreign investment will be recorded on the credit side because it brings in foreign exchange.

Download our appand get started for free

Experience the future of education. Simply download our apps or reach out to us for more information. Let's shape the future of learning together!No signup needed.*

Similar Questions

- 1View SolutionDifferentiate between Currency Depreciation and Currency Appreciation.

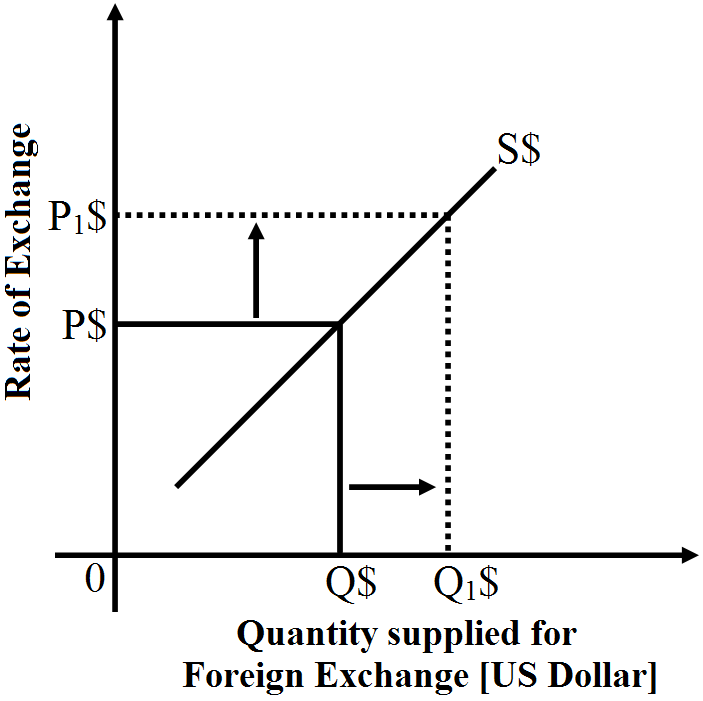

- 2View SolutionWhy supply curve of foreign exchange is upward sloping?

- 3View SolutionDifferentiate between balance of trade and current account balance.

- 4View SolutionWhere is 'borrowings from abroad' recorded in the Balance of Payments Accounts? Give reasons.

- 5View SolutionGiving two examples, explain why there is a rise in demand for a foreign currency when its price falls.

- 6View SolutionWhat is balance of payments account? Where are the borrowings from abroad recorded in it and why?

- 7View SolutionWhat is the marginal propensity to import when M = 60 + 0.06Y? What is the relationship between the marginal propensity to import and the aggregate demand function?

- 8View SolutionHow is exchange rate determined in the foreign exchange market? Explain.

- 9View SolutionName the broad categories of transactions recorded in the 'Capital account' of the Balance of Payments Accounts.

- 10View SolutionClassify whether the following trans actions will be recorded in current account or capital account.

- Purchase of shares of Tata by Microsoft.

- Imports of computer spare parts from America.

- Borrowings from World Bank.

- Repayment of loan by Indian Government taken from Japan.

- Gifts received from a relative in Australia.

- Purchase of Land in China.

- Import of machinery.