How is foreign exchange rate determined in the market?

The flexible exchange rate is determined by the forces of demand and supply of foreign exchange in the foreign exchange market.

The demand curve for foreign exchange $($say dollars$)$ varies inversely with the exchange rate.

As the exchange rate rises, less foreign exchange rate is demanded and vice versa.

The demand curve for foreign exchange is downward sloping.

The supply curve of foreign exchange $($say dollars$)$ varies directly with the exchange rate.

As the exchange rate rises, the supply of foreign exchange increases and vice versa.

The supply curve of foreign exchange is upward sloping.

The flexible exchange rate is determined at a point where the ‘demand for’ and ‘supply of’ foreign exchange are equal,

i.e., Demand for foreign exchange $($say dollars$) =$ Supply of foreign exchange $($say dollars$).$

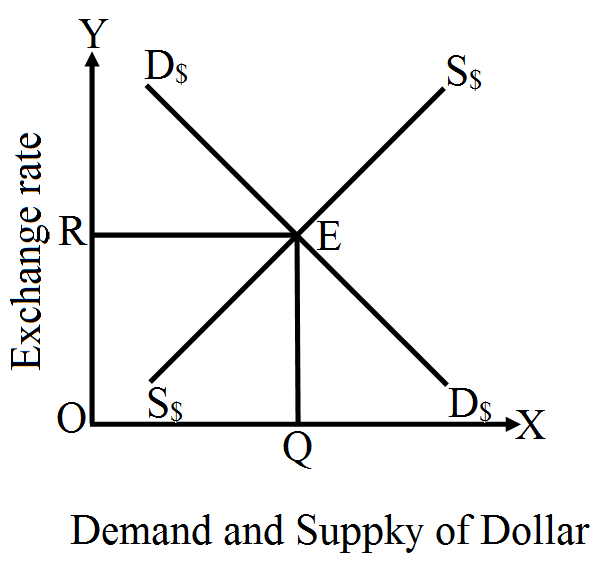

The diagram illustrates determination of equilibrium exchange rate.

The diagram shows that demand for dollar $(D)$ and supply of dollar $(S)$ curves intersect each other at point $E.$

The equilibrium exchange rate is $OR$ and the equilibrium quantity is $OQ.$

The demand curve for foreign exchange $($say dollars$)$ varies inversely with the exchange rate.

As the exchange rate rises, less foreign exchange rate is demanded and vice versa.

The demand curve for foreign exchange is downward sloping.

The supply curve of foreign exchange $($say dollars$)$ varies directly with the exchange rate.

As the exchange rate rises, the supply of foreign exchange increases and vice versa.

The supply curve of foreign exchange is upward sloping.

The flexible exchange rate is determined at a point where the ‘demand for’ and ‘supply of’ foreign exchange are equal,

i.e., Demand for foreign exchange $($say dollars$) =$ Supply of foreign exchange $($say dollars$).$

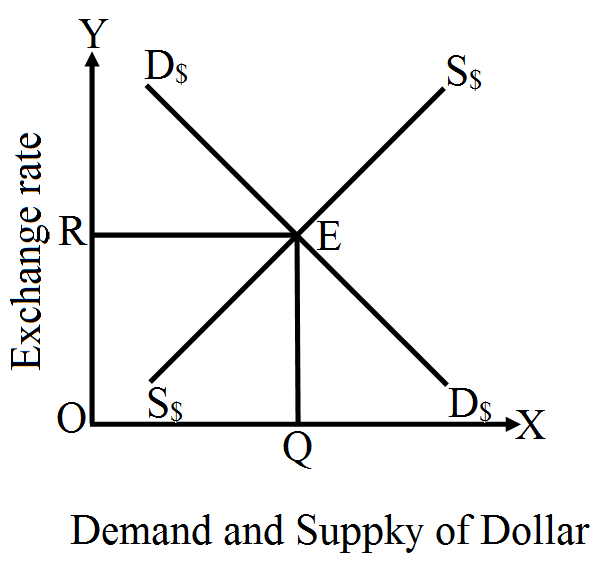

The diagram illustrates determination of equilibrium exchange rate.

The diagram shows that demand for dollar $(D)$ and supply of dollar $(S)$ curves intersect each other at point $E.$

The equilibrium exchange rate is $OR$ and the equilibrium quantity is $OQ.$

Download our appand get started for free

Experience the future of education. Simply download our apps or reach out to us for more information. Let's shape the future of learning together!No signup needed.*

Similar Questions

- 1View SolutionExplain the distinction between the flexible exchange rate and the managed floating exchange rate.

- 2View SolutionGive the meaning of 'foreign exchange' and 'foreign exchange rate'. Giving reason, explain the relation between foreign exchange rate and demand for foreign exchange.

- 3View SolutionDiscuss briefly the meanings of:

- Fixed Exchange Rate.

- Flexible Exchange Rate.

- Managed Floating Exchange Rate.

- 4View SolutionDefine fixed exchange rate. How is the exchange rate determined in a flexible exchange rate system?

- 5View SolutionExplain the distinction between autonomous and accommodating' transactions in balance of payments. Also explain the concept of balance of payments 'deficit' in this context.

- 6View SolutionIn the above example, if exports change to X = 100, find the change in equilibrium income and the net export balance.

- 7View SolutionExplain by giving examples, the distinction between depreciation and devaluation of domestic currency.

- 8View SolutionSuppose C = 100 + 0.75Y D, I = 500, G = 750, taxes are 20 percent of income, X = 150, M = 100 + 0.2Y . Calculate equilibrium income, the budget deficit or surplus and the trade deficit or surplus.

- 9View SolutionSuppose C = 40 + 0.8Y D, T = 50, I = 60, G = 40, X = 90, M = 50 + 0.05Y.

- Find equilibrium income.

- Find the net export balance at equilibrium income.

- What happens to equilibrium income and the net export balance when the government purchases increase from 40 and 50?

- 10View Solution

- In which sub-account and on which side of balance of payments account will foreign investments in India be recorded? Give reasons.

- What will be the effect of foreign investments in India on exchange rate? Explain.